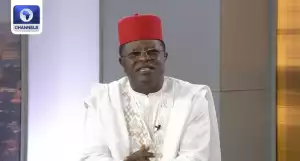

We'll sustain weighted average cost of funds — Unity Bank Boss

.jpg?w=900&ulb=true&ssl=1)

We'll sustain weighted average cost of funds — Unity Bank Boss

By Peter Egwuatu

Managing Director of Unity Bank Plc, Mr. Henry Semenitari has explained that the bank would remain profitable as long as it is able to maintain reasonable Weighted Average Cost of Funds (WACF).

In an interview with newsmen in Lagos on the performance of the bank over the years, he said

The most important parameter for us, in terms of looking at our business fabric, and which will remain our watchword as a bank is to sustain a reasonable level of WACF.

“The truth is that if you sustain the Weighted Average Cost of Funds, your profit is going to rise, no matter the business you run, the Weighted

Average Cost of Funds is so critical for the life of a retail enterprise. We have come from a long range to five per cent as against 6.8 per cent in 2013. The industry average is 5.5 per cent.

In the best practice environment, the ability to price money is very critical. What do you do as a bank? We don’t print money, we don’t own money. It is the money that a depositor gives to us that I give out to a borrower at a margin. If I take money at a wrong cost, I give it out at a wrong price. And that is where default starts.

Eighty per cent of those defaults are from the fact that the cost of borrowing is abnormal. Most times, it comes from the cost at which I will price money. Indeed for us, going by the tempo we are going by 2017, our WACF will be about two per cent. It is achievable if we continue to drive low cost. That is where we are. It is a very important index. The next is cost to income ratio, which has a relationship with contribution as well; a relationship to work done as a function of what are you gaining from work” he explained.

Cost to income ratio:

When asked what the bank has done in terms of cost to income ratio, Semenitari said “We have gone to 60.03 per cent, industry average is 71.5 per cent. Here we are coming from a negative, same network, same people. It is all about how have you decided to do your work better.Net interest margin improved to 66.3 per cent. This is better than the industry average of 63.5 per cent Again, there is a link with your WACF. That is why we have to put in order of flow.

“Earnings Per Share (EPS) improved by 28.76 kobo, coming from 4.40 kobo in Q3 of 2013. And the market capitalization is N58.45billion. Now one albatross that hit most institutions with legacy background like ours is non-performing loans(NPLs). We are back on aggressive“recovery drive. On the recovery side, I want to thank the media for assisting us through media education; advertorials, encouraging people to realize that borrowing money is not a crime, but when you don’t repay your debt, it becomes a crime.

“We went on that. Our NPL have“gone down from over 50 per cent, say half the entire loan book we inherited, to 20.43 per cent. The impact of the recovery drive will be felt more in the coming years which will improve our NPL ratio and our projection is that, coming December 2015, it will get to 10 per cent. I believe it is achievable. And by December 2016, we would be below five per cent, which is the regulatory standard of NPL.”“On capital raising, he said “We embarked on desired capital raising exercise.

“It was inevitable after such write-downs to N33billion loss. There is no way you could tell anybody that your capital is inadequate. Again, I did say, with goodwill, part of building back the franchise is to“ensure that you gain confidence in the Nigerian public and the existing shareholders.”

![Madura Veera (2024) [Telugu]](https://www.memesng.com/r/storage.waploaded.com/images/c640737bd7e17dc944d46408cfac4b62.jpg?w=50&ulb=true&ssl=1)

![Fifty Shades of Grey (2015) [+18 Sex Scene]](https://www.memesng.com/r/storage.waploaded.com/images/0a2820017a6de4a39d53f275c673fcc3.jpg?w=50&ulb=true&ssl=1)

![Sex Games (2023) [Fil] [+18 Sex Scene]](https://www.memesng.com/r/storage.waploaded.com/images/4f3464bd8079321fc85ee5c85cac1236.jpg?w=50&ulb=true&ssl=1)

{{comment.anon_name ?? comment.full_name}}

{{timeAgo(comment.date_added)}}

{{comment.body}}

{{subComment.anon_name ?? subComment.full_name}}

{{timeAgo(subComment.date_added)}}

{{subComment.body}}